To balance out monetary business sectors and backing action because of the COVID-19 pandemic, numerous national banks have utilized resource buy programs—on account of a few developing business sectors and creating economies (EMDEs), interestingly. Albeit these projects seem to have at first assisted with bringing down government security yields, their more extensive macroeconomic results presently can’t seem to be seen. The projects present dangers in case they are seen to fund unreasonable monetary deficiencies, or on the other hand in case they are extended without the extraordinarily accommodative macroeconomic arrangements authorized by cutting-edge economies. Implanting resource buy programs in a straightforward money-related arrangement structure that is reliable with expansion and monetary security targets will decrease these dangers.

An assorted arrangement of program plans

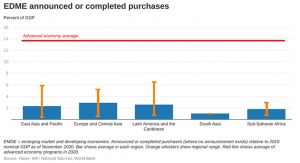

In 2020, national banks in 18 EMDEs declared or executed resource buy programs zeroed in on nearby money government securities. The size of buys fluctuated from under 1% to 6% of GDP, fundamentally more modest than the projects dispatched in cutting-edge economies. Now and again, in any case, the resource buys keep on developing. Numerous EMDE national banks have not declared the scale or span of buys. While most have been buying just in optional business sectors, some have bought bonds straightforwardly from governments with the goal of financing rising monetary shortages.

A bar diagram showing EDME declared or finished buys in locales

Decrease in long haul security yields

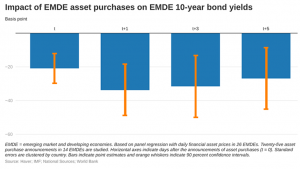

Declarations of resource buy programs seem to have balanced out security markets and lift value costs while having tried not to come down on monetary forms. The consequences for long haul security yields and value costs have been normal more prominent than the impacts of declarations of financial approach rate slices in light of COVID-19. Also, the declaration impact of EMDE resource buys on government security yields seems to have been bigger than the declaration impacts of cutting edge economy resource buys. The more extensive macroeconomic ramifications, be that as it may, still need to be worked out.

Bar diagram showing Impact of EDME resource buys in EMDE 10-year security yields

Dangers to national bank validity and impression of obligation adaptation

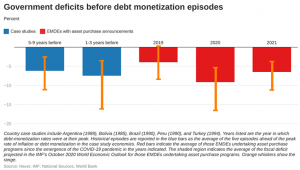

During the 1980s and 1990s, some EMDE national banks financed monetary shortfalls. These scenes of obligation adaptation contrast from late examples in having been gone before by significant stretches of high expansion, outside obligation defaults, and tenaciously high financial shortfalls, set against the setting of less valid financial and money-related systems. For the present, macroeconomic conditions in EMDEs are more harmless than in those chronicled scenes, and financial and monetary specialists have set up more noteworthy validity. Nonetheless, history is a token of the dangers to national bank validity if resource buy programs are utilized for delayed money-related financing of monetary deficiencies.

A bar diagram showing Government shortfalls before obligation adaptation scenes

Future viability

The new experience of EMDE resource buy projects might exaggerate their future viability. To begin with, they were set against the scenery of exceptionally accommodative full-scale monetary strategies in cutting-edge economies that could be dependent upon inversion. Second, they were an unforeseen takeoff from the prior arrangement direction of EMDE national banks that had zeroed in on buttressing their autonomy. Third, delicate liquidity conditions in EMDE monetary business sectors are helpful for unstable developments in resource costs, conceivably prompting unseen side effects.