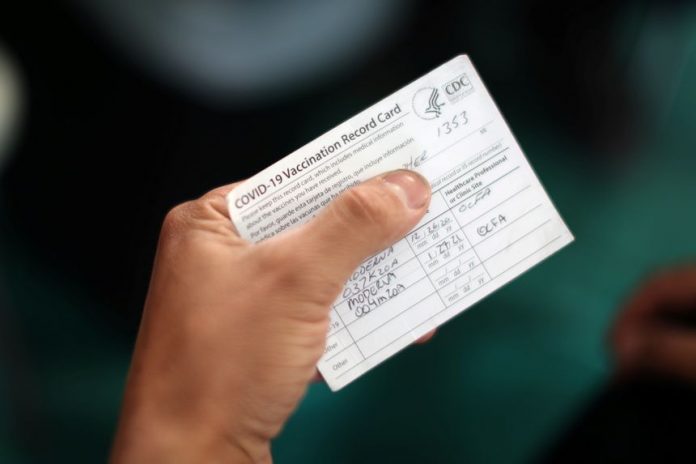

In excess of 167 million Americans have gotten essentially their most memorable portion of the COVID immunization, as per the Centers for Disease Control.

Be that as it may, certain individuals are as yet hesitant to make the effort, whether as a result of its hurried turn of events and rollout or general hesitations about immunizations.

One more component causing fear for some is whether or not taking the antibody will affect wellbeing and extra security inclusion.

Online deception has spread the feeling that any symptoms of COVID immunizations won’t be covered by your ongoing insurance contract.

Assuming that is the reason you’re holding off on getting an immunization, you shouldn’t need to stress. This is more on the way protection suppliers are taking care of the immunization and how you can look for inclusion with certainty.

Will the immunization influence your medical coverage?

Nobody needs to get an unexpected doctor’s visit expense or dismissed guarantee, particularly while they’re recuperating from sickness.

On the off chance that you’re intending to look for a reasonable health care coverage plan before open enlistment closes on May 15, you might be stressing over how receiving available immunizations against COVID might affect your choices.

While every one of the presently accessible antibodies was thoroughly tried prior to being endorsed for mass use, they’re still new medications. A specific measure of mindfulness with regards to your wellbeing is never something terrible.

Be that as it may, the CDC has said all immunizations remembered for the progressing rollout are protected and successful, so your protection supplier won’t be the one to disrupt the general flow of you having a chance.

The main way you might be denied inclusion is assuming you become ill before your strategy clears the standard 15-to 30-day holding up period.

That would be sad, yet it’s even more motivation to secure a strategy sooner than later.

Will it influence your disaster protection?

As of late, talk has been flowing internet based that a lady was told by her life coverage supplier that if she somehow managed to pass on in the wake of getting a COVID immunization, her family wouldn’t get a demise benefit on the grounds that the antibody is “trial.”

The insurance agency being referred to, Manulife, has stood up to deny the cases and explain that the supported immunizations, which are not trial, have no effect either on claims or on future inclusion.

Another post became famous online through Instagram, where a lady guaranteed her companion’s auntie kicked the bucket from the COVID immunization, and her disaster protection guarantee was denied.

The two posts have been pulled down from the web-based entertainment locales for spreading bogus data, yet the feelings of dread behind them are genuine.

As Americans have gone through the last year understanding a once-in-a-century pandemic, being on guard has turned into the standard.

Yet, with the bits of gossip whirling, the protection business is quick to put any misinformation to rest.

Whit Cornman, a representative for the American Council of Life Insurers, affirmed Factcheck.org in an email that life guarantors don’t look at whether a policyholder has gotten the COVID immunization while deciding if to pay out a case,

In all actuality, he adds, there are not very many events where your disaster protection organization can deny your case. The most well-known reasons include policyholders lying or keeping important data on their applications.

So on the off chance that you told the truth during the application stage, you don’t have anything to stress over — gave you don’t become ill before your arrangement clears the holding up period.

With that dread suppressed, you can shop straightforwardly for a reasonable disaster protection strategy to guarantee your family will be covered if anything somehow managed to happen to you.

And your different approaches?

A great many people consider protection something they need to get for good measure. Be that as it may, on the off chance that you just gobbled up the primary insurance contract you found, you might be overpaying by many dollars consistently.

The most effective way to get a good deal on your different insurance contracts is by contrasting something like three statements prior to choosing a proposition. However, that cycle doesn’t need to be as much work as it seems.

When your well-being and life strategies are settled up, why not utilize a statement contrasting site with naturally look at rates for different types of protection?

Finding a more reasonable auto strategy and property holders strategy could assist with opening up one more hardly any hundred bucks in your financial plan consistently.

With those worries about the antibodies set out to settle and this additional cash in your pocket, you may before long be on to additional significant concerns like concluding how you ought to spend your excess.