Current home credit financing costs are at the best they’ve been in numerous years. This implies individuals needing to purchase a home or renegotiate have the chance to set aside cash. A loan fee of even 1% beneath the thing you’re right now paying can have a major effect month to month. Moreover, you have the chance presented to ponder for how long you need to take care of your home. In the event that renegotiating the distinction in interest installments may permit you to abbreviate your result time without inconceivably expanding regularly scheduled installments.

Stage one in looking for your home loan is choosing what kind of home loan you need. Do you lean toward a decent rate that gives you a regularly scheduled installment that never shows signs of change or a customizable rate that changes your installments when the premium goes up or down? There are likewise expand contracts, VHA contracts, VA contracts, interest just home loans… all things considered, you get the picture. Until you realize what kind of home loan best suits your conditions you could undoubtedly wind up contrasting altogether different instruments and confounding yourself.

Exploring the universe of momentum home credit loan fees and home loans can feel more like soaking in a tide. There are many guidelines and guidelines that oversee loaning, so next to having a sense for what kind of home loan you need it doesn’t damage to get the assistance of an expert, for example, a home loan representative, who can clarify what different terms mean and submit suggestions fit to your conditions.

Try not to be tricked by extravagant guarantees. Loaning is BIG business and there are some fairly corrupt players in the game. So before you leave all necessary signatures for any such administrations, check with the neighborhood Better Business Bureau or other customer guard dogs. See what sort of rating and criticism they have on record before you go into a limiting relationship.

Understand that various moneylenders have various terms. Their costs to secure a loan fee, shutting costs, beginning expenses, organization charges, endorsing expenses and so forth will be unique. Plunk down and line up different loan specialists’ contributions line by line so you can truly see who is offering you the best bundle by and large.

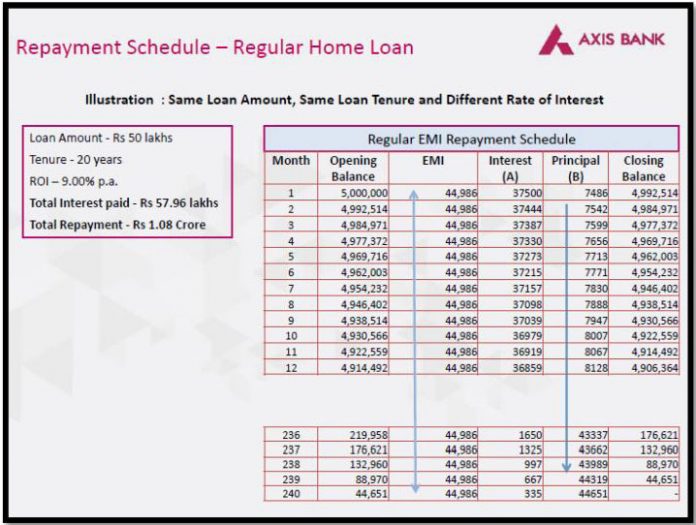

Model HERE

It is totally conceivable to get the best current home credit financing costs. The key is making you an educated shopper who poses inquiries and finds straight solutions. In the event that you feel that something is amiss, attempt another loan specialist. You’re putting huge amount of cash in something that ought to be a YES, not a MAYBE.

Best home loan rates Canada, the best fixed home loan rates and the best renegotiate contract rates are accessible for you here with the assistance of Perry Pappas, an accomplished home loan dealer in Canada.